Chinmaya Mission Alpharetta (CMA) is a registered non-profit organization, classified as a 501c(3) entity by the IRS. Any donations to CMA are tax deductible by the donor, to the extent permitted by law. CMA relies on donations from generous donors like you to sustain and grow its activities, and fulfill its motto of providing maximum happiness to maximum people for maximum time.

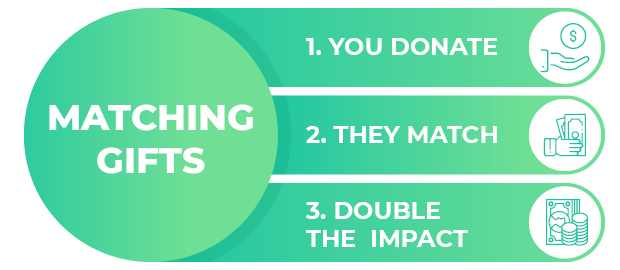

When you donate to CMA, you also have an opportunity to double the impact of your donation. You might be wondering how to make it happen.

Have you heard of Corporate matching gifts?

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. Corporations also support the volunteer hours that their employees spend serving at the non profit organizations by making a financial gift for the number of hours spent.

Why do companies match donations?

Companies of all sizes match donations their employees make to nonprofits because it’s an easy, structured way for them to support good work in their communities. CSR, or corporate social responsibility, is an important factor in how the public perceives brands and companies these days.

Corporate matching gifts are an efficient and straightforward way for companies to build relationships with charities. Corporations get a big tax break for supporting 501 c(3) organizations. Besides, supporting the charity that their employee supports makes the employee happy and hence more productive. It is a WIN-WIN situation for all.

Why do organizations overlook corporate matching gifts?

Nonprofits often struggle with receiving these gifts because so few donors know about their employer’s corporate philanthropy programs. Nonprofits also don’t always know who someone’s employer is or what their specific policy is.

So what does this mean for us?

When you pay your Bala Vihar fees, a large portion of it is considered a tax deductible donation. You would have recently received a donation receipt stating the amount that can be claimed as a tax deduction by you. This is the amount that can be matched by your employer.

How can you help?

- Check with your employer, if they match charitable donations. If you prefer, please reach out to us and we can help you figure this part out.

- If CMA is an approved charity by your employer, then the next step is to upload the donation receipt we have sent you through your employee portal. Fill out the information they ask, and submit the form, that’s it!

- If CMA is not in the list of supported charities, then you can nominate CMA. The HR department will have you fill out another form, asking details of CMA. We will help you out for this. After the nomination is approved, upload the donation receipt, and you are done!

It is a really simple process, and we hope that all of you will consider applying.

Time is of essence

Many corporations will start closing out before the end of calendar year . We need to make this move as quickly as possible. A volunteer will reach out to you personally, to figure out if you need help doing this. before end of calendar year or something

Let us all work towards making our donation dollars go further, and double the good we can do for our society.